Free Case Evaluation

(253) 272-5226Free Case Evaluation

(253) 272-5226How good is your auto insurance company?

When you are considering the answer to that question are you only thinking about the premiums? Have you ever considered how your insurance company handles claims? What good is a cheap premium if the insurance benefits are denied when you need them most?

At Ladenburg Law Injury Attorneys, we deal with auto insurance companies every day. We know which companies are good to their customers and which companies fight at every turn. To some extent, all insurance companies dispute or delay claims. After all, their profit model is entirely dependent upon taking in more money than they pay-out. The more pay outs they can deny, the more profit they make.

A common way insurance companies try to make money is to deny PIP benefits. Personal Injury Protection or PIP, is coverage that will pay for your medical expenses if you have been injured in a collision. PIP is very important especially for people with high deductible health insurance or no health insurance. It allows injured people to get the treatment they need right away and without worrying about how they are going to pay for their care.

In theory, PIP is great. In practice, payments can often be delayed or denied. Insurance companies will often argue that treatment is unreasonable, costs too much, or is not related to any injury caused by the collision. They will sometimes require the healthcare providers to re-submit bills and documentation several times before payment will be issued. These tactics can delay necessary treatment or cause unpaid medical bills to be sent to collections.

Most people have no idea whether or not their insurance company is reasonable when it comes to PIP payments. They usually do not learn the answer until it is too late. Because we see how these companies treat their customers on a daily basis, we notice trends in their behavior. We know which companies will likely delay or deny payments. In our experience, one company stands above the rest when it comes to denying payments for medical bills and gets an F grade from Ladenburg Law. That company is USAA.

USAA frequently denies payment to our clients’ health care providers. They use a company called Auto Injury Solutions or AIS to review the submitted medical bills. Doctors working for AIS will decide if the treatment was reasonable or necessary without ever examining the client. If they determine the client should not have been injured as bad as they claim, payment will be denied.

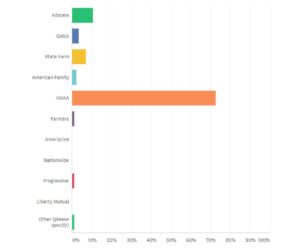

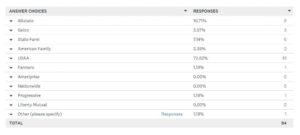

Is our experience at Ladenburg Law unique? Maybe we just have had a large number of USAA clients with bad luck. I wanted to find out, so I took a survey of other lawyers in Washington State who handle auto collision cases. I asked one simple question: Which PIP or Med-Pay provider is the most difficult to deal with in your practice?

I received 84 responses to my survey question. Here are the results:

I hope you are never injured in a collision. If you are, I hope you don’t have USAA insurance.