Free Case Evaluation

(253) 272-5226Free Case Evaluation

(253) 272-5226When your lawyer sends off a demand letter to the insurance company, he or she kicks off the negotiation process. In essence, the demand letter asks for a certain amount of money for the injuries you’ve suffered. By law, the insurance company must respond and negotiate in good faith to settle the claim. Thus, it may take a month or two to arrive at a settlement amount once the demand letter has been sent.

If you’ve been injured and are patiently waiting for news on a settlement, you’re likely curious about the timeframes involved. Perhaps you’ve heard your lawyer or paralegal mention they’re preparing or have already sent a “demand letter” out. In this post, we’ll explain how demand letters work and how close you are to (hopefully) getting that check.

In personal injury law, a demand letter is a formal request for compensation from the person who caused the accident. Most often, this letter gets sent to that person’s insurance company. After all, it’s the insurance company who’s most likely to compensate you for your injuries and other harm.

A demand letter typically accomplishes the following:

At our injury firm, we make sure our clients are informed before we send out the demand letter on their behalf. We’ll discuss what we think their case is worth and recommend an amount to request in the demand letter.

The demand letter is most often sent after you’ve completed your treatment. The reasons for this is straightforward. It’s only after you’ve fully recovered that you have a full picture of your injuries. Armed with medical bills, doctor reports, and your own informal updates, your lawyer has the best picture of what a fair settlement for your case would look like.

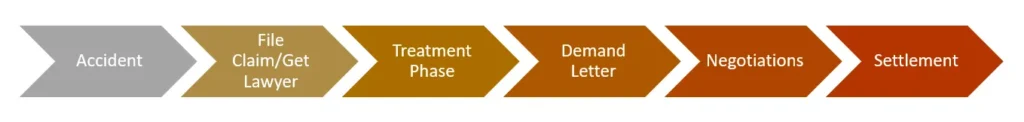

Here’s a visual to illustrate where the demand letter falls in a standard personal injury case:

Once the letter is sent, negotiations can begin about your settlement. In terms of time frames, it can take several months of treatment before your lawyer sends that demand letter. Once it’s been sent, it may take another couple months to hear from the insurance company, negotiate, and receive your settlement.

There are steps you can take that will help your lawyer put together the best demand letter possible for you. Believe it or not, these thigs have the potential to make a difference in your settlement amount.

So, here’s how to help your case:

The insurance company typically has about 30 days to respond to the demand letter. Rarely will they agree to the exact dollar amount your lawyer requested. In fact, don’t be surprised if you hear they counter-offered with a very low figure.

From here, your lawyer will likely engage in a few back-and-forth exchanges to arrive at a fair number. One of two things could happen next:

We’ve written about what happens if you choose to file a lawsuit. There are potential risks and benefits that you should carefully weigh with your lawyer. And you should be aware that filing a lawsuit will certainly delay the process. Ultimately, this means you’ll delay seeing any money from your case by several more months, if not longer.

Could you put together a demand letter yourself? Of course – you can. But consider the power of having a demand letter coming from your attorney. The insurance company will understand that you are serious about being treated fairly. Also, they’ll know that you’re able to file a lawsuit if negotiations fail. Because of this, you’re more likely to end up with a bigger settlement than if you would’ve attempted on your own.

It’s always free to speak with one of our lawyers. In fact, we only charge a fee if we’re able to win you a settlement. To get started, fill out the short form on our website or give us a call at (253) 272-5226.